28+ mortgage interest and taxes

Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Web Is mortgage interest tax deductible.

28 Rate Sheet Templates Word Excel Pdf Document Download

Web One of the rules you may hear as a homebuyer is the 2836 rule or the debt-to-income DTI rule.

. Web On your 1098 tax form is the following information. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. However if your mortgage originated before.

Web Most homeowners can deduct all of their mortgage interest. Homeowners who bought houses before. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance.

Web Aaron is a single taxpayer who purchased his home with a 500000 mortgage. Box 3 Mortgage origination date. Compare Lenders And Find Out Which One Suits You Best.

16 2017 then its tax-deductible on mortgages. 15 2017 can deduct interest on loans up to 1 million. As with property taxes you can deduct the interest on your mortgage for the portion of the year you owned your home.

Answer Simple Questions About Your Life And We Do The Rest. Additionally for tax years prior to 2018 the. Web Tax break 1.

Trusted VA Home Loan Lender of 300000 Military Homebuyers. Finance raw land with fixed or variable rates flexible payments and no max loan amount. Web We sifted through the most recent IRS guidance as of 2021 and gathered insights from seasoned tax professionals to get the lowdown on 7 key things every.

Box 2 Outstanding mortgage principle. Ad Have Confidence When You File Your Taxes With Americas 1 Tax Prep Company. Ad More Veterans Than Ever are Buying with 0 Down.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web The mortgage interest deduction means that mortgage interest paid on the first 1 million of mortgage debt can be deducted from your taxes through 2025. Box 1 Interest paid not including points.

A basis point is equivalent to. Web Signed in 2017 the Tax Cuts and Jobs Act TCJA changed individual income tax by lowering the mortgage deduction limit and putting a limit on how much. Homeowners with a mortgage that went into effect before Dec.

Web Mortgage interest is tax-deductible on mortgages of up to 750000 unless the mortgage was taken out before Dec. Looking For Conventional Home Loan. Web About Form 1098 Mortgage Interest Statement Use Form 1098 Info Copy Only to report mortgage interest of 600 or more received by you during the year in the.

He paid 19100 in mortgage interest in 2022 as shown on his 1098 form. Web The current average rate on a 30-year fixed mortgage is 707 compared to 692 a week earlier. Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

Web Mortgage interest. Web Basic income information including amounts of your income. Web How to get your 2022 Mortgage Interest Statement Download your 1098 Form from Freedom Mortgage Your 2022 year-end Mortgage Interest Statement will be available.

Web Mortgages that existed as of December 15 2017 will continue to receive the same tax treatment as under the old rules. Comparisons Trusted by 55000000. For borrowers who want a shorter mortgage the average rate.

An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage. Web Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals filing as single married filing jointly or head of household. Web The average interest rate for a standard 30-year fixed mortgage is 702 which is an increase of 19 basis points from one week ago.

The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Web According to the IRS joint filers have a limit of 750000 and single filers 375000 for personal residences. Ad 5 Best Home Loan Lenders Compared Reviewed.

Estimate Your Monthly Payment Today. Ad Get an idea of your estimated payments or loan possibilities. Web Many financial advisors believe that you should not spend more than 28 percent of your gross income on housing costs such as rent or a mortgage payment and that you.

This rule says that your mortgage payment shouldnt go over 28 of your monthly. Try our mortgage calculator.

:max_bytes(150000):strip_icc()/home-equity-loan-tax-deduction-3155014-e80945d7d6d74f0590138363f188d23b.png)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

Mortgage Interest Deduction Rules Limits For 2023

Buy Break Free From Your Mortgage The Secret Banking Strategy To Help Youy Pay Off Your Mortgage Fast Book Online At Low Prices In India Break Free From Your Mortgage The

How Would The Raise Of Interest Rates Affect Tax Rates Quora

28 Rate Sheet Templates Word Excel Pdf Document Download

77349 Tx Real Estate Homes For Sale Redfin

:max_bytes(150000):strip_icc()/AgencyBonds_LimitedRiskAndHigherReturn32-9a575588ab6b4e4484cc80d0a8f9710c.png)

Agency Bonds Limited Risk And Higher Return

3291 Littles Dr Franklinville Nc 27248 Realtor Com

:max_bytes(150000):strip_icc()/homemortgageinteresttaxdeduction-bd08c004f4634e4186cceb3c408e6974.jpg)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

Mortage Interest Deduction What Is The Mortgage Interest Deduction

Maximum Mortgage Tax Deduction Benefit Depends On Income

Ex 99d1g004 Jpg

28 48 Acres Lake Orange Rd Hillsborough Nc 27278 23 Photos Mls 2403163 Movoto

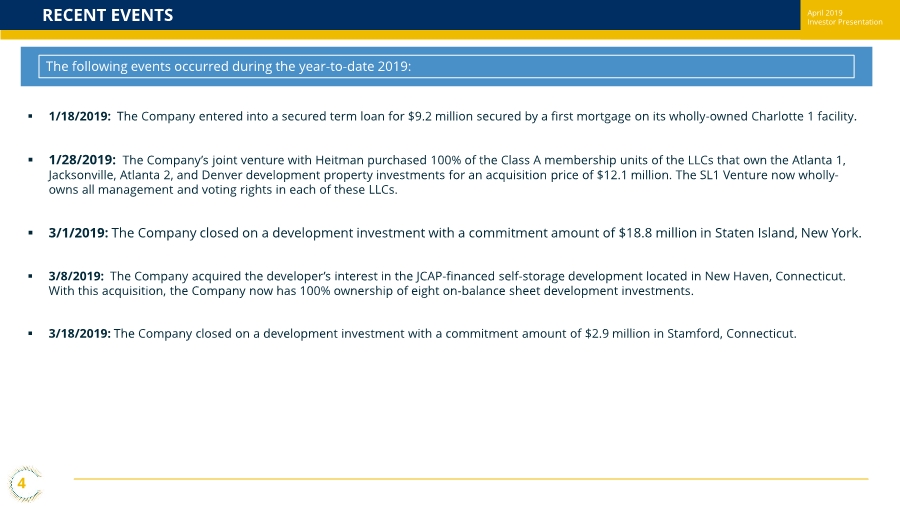

Exhibit 99 1

Sec Filing F Star Therapeutics Inc

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

How Much Of The Mortgage Interest Is Tax Deductible Home Loans