Ifrs 16 depreciation calculation

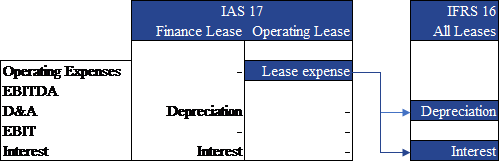

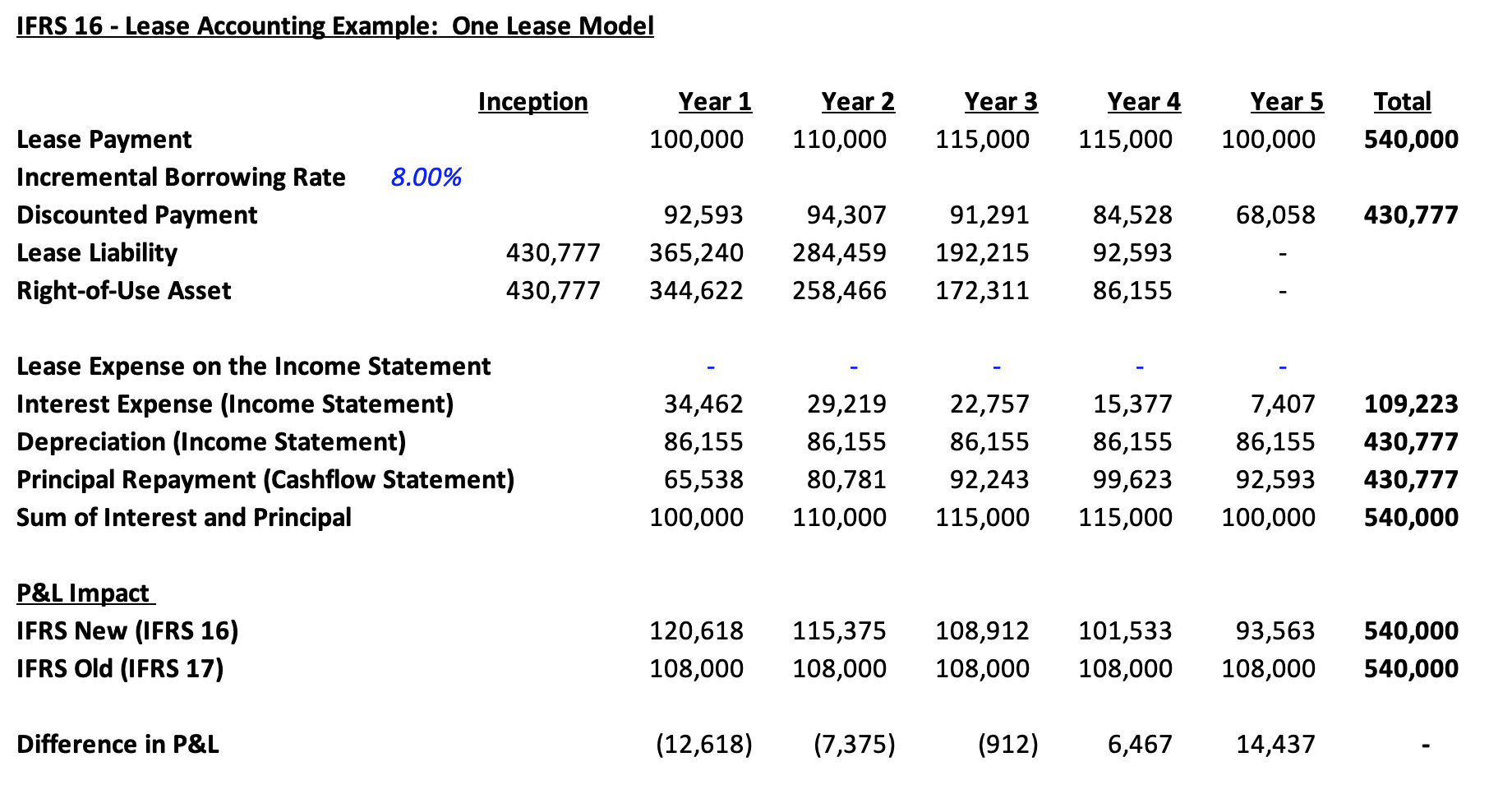

The introduction of IFRS 16 will lead to an increase in leased assets and financial liabilities on the balance sheet of the lessee while Earnings before Interest Tax Depreciation and. 77793 12999 14169 15444 16834 18349.

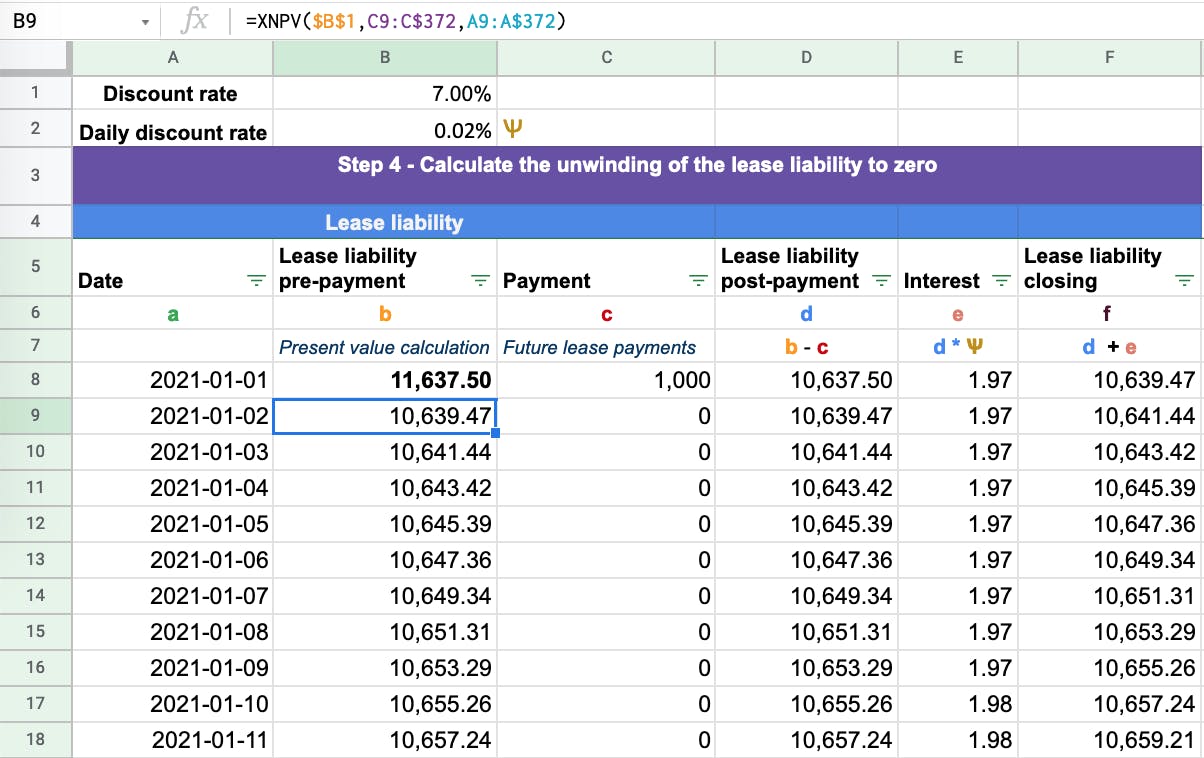

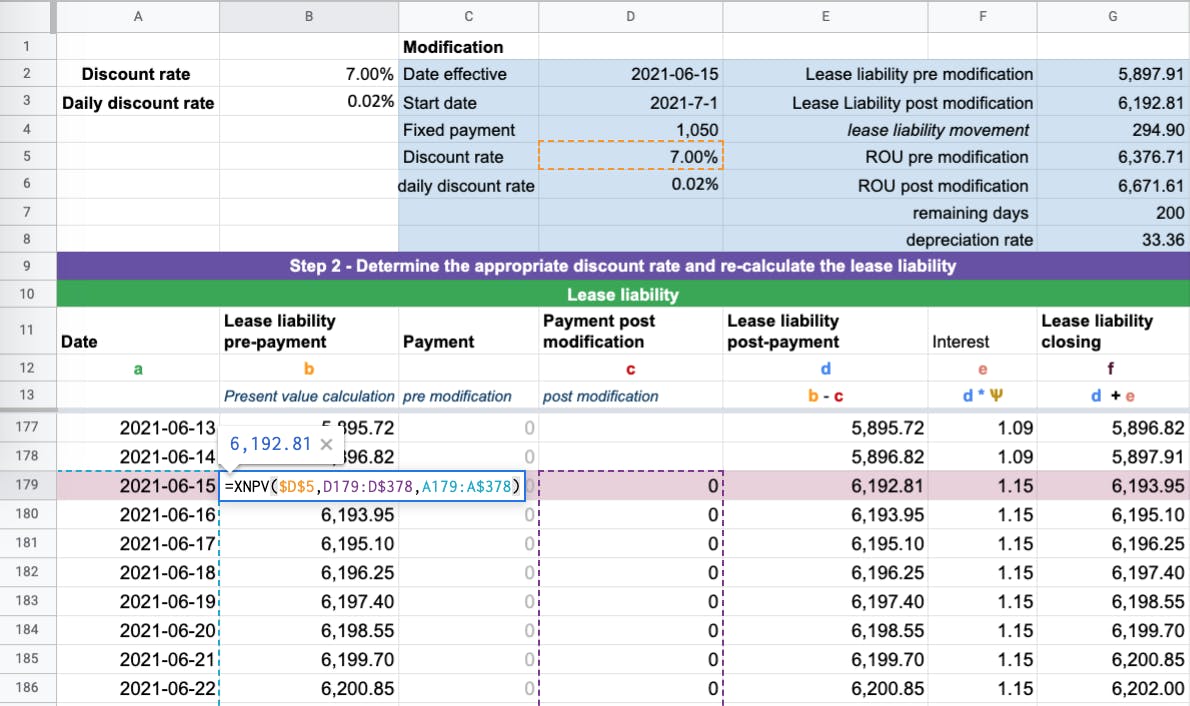

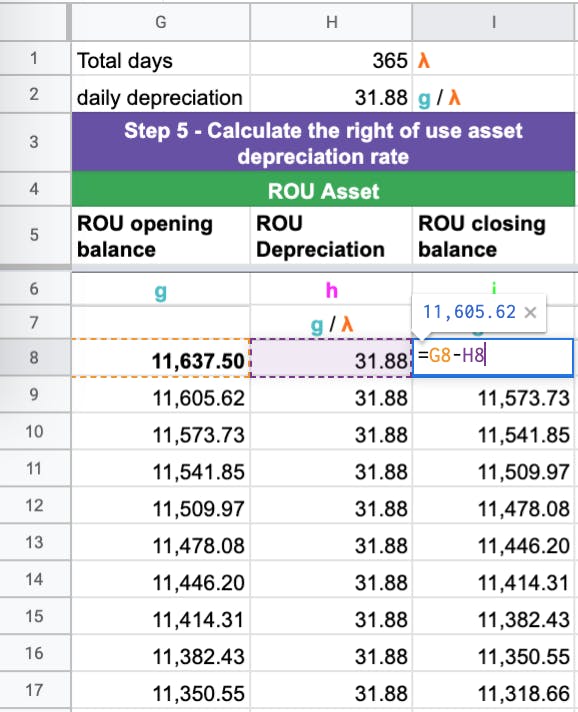

How To Calculate A Lease Liability And Right Of Use Asset Under Ifrs 16

Liability balance year 4.

. Unlimited users pay-per-lease pricing SOX compliant 99 client renewal rate. IFRS 16 replaced the old standard IAS 17. Depreciable amount Cost of an asset residual value.

Ad Schedule A Free Demo With The Lease Accounting Experts At LeaseQuery Today. While Excel can help with a small number of leases there is a point beyond which the manual calculation and management of leases is no longer tenable. In addition a lease contract calculation.

This is due to changing accounting standards to IFRS 16 in 2019 will require retrospective restatement to meet the requirement. Ad QuickBooks Financial Software For Businesses. Rated The 1 Accounting Solution.

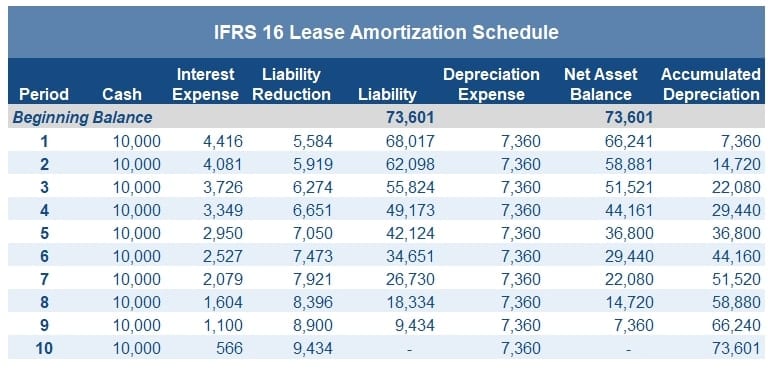

It will replace IAS 17 Leases for reporting periods beginning on or after 1 January 2019. It is important to remember that. To perform depreciation calculation first we must find the depreciable amount.

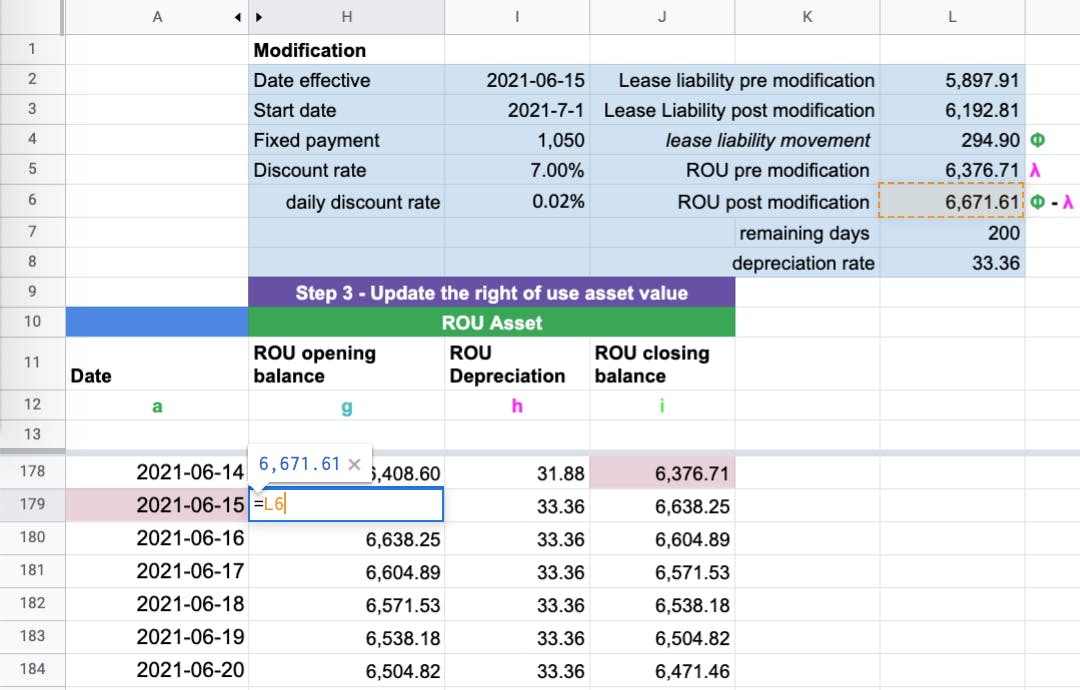

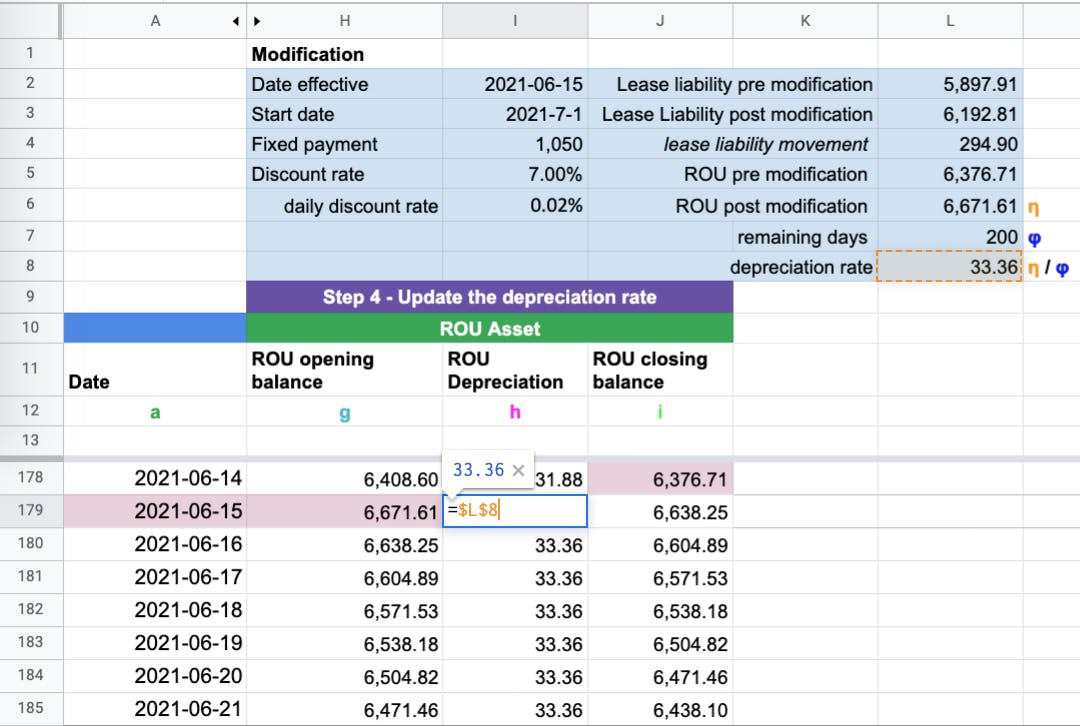

Ad Get A Free No Obligation Cost Segregation Analysis Today. However it does simplify the calculation for the pre-IFRS 16 version. The next step is to calculate the carrying amount of the right-of-use asset at the end of year 4.

IFRS 16 Leases was issued by the IASB in January 2016. It can be applied before that date by. Appendix A Interest rate implicit in the lease The interest rate that yields a present value of a the lease payments and b the unguaranteed residual value equal to the.

Ad Get A Free No Obligation Cost Segregation Analysis Today. This is not necessary in order to get to the correct answer. For an example of the guidance for accounting standard.

In this case we need to determine the present value of. Ad Schedule A Free Demo With The Lease Accounting Experts At LeaseQuery Today. Jennifer has over 16 years of experience in audit and technical accounting.

The amendment addresses the issue in paragraph 35 of IAS 16 and paragraph 80 of IAS 38 by clarifying that. Jennifer has over 16 years of experience in audit and technical accounting. Issued IFRS 16 Leases IFRS 16 or the new standard in January 2016 with an effective implementation date of 1 January 2019.

Ad Watch our enterprise lease accounting software demo for ASC 842 IFRS 16. The ROU asset depreciation expense journal entry is based on the amount in the Depreciation Expense column. Ad Watch our enterprise lease accounting software demo for ASC 842 IFRS 16.

Reduce Your Income Taxes - Request Your Free Quote - Call Today. The IASB has clarified that the use of revenue-based methods to calculate the depreciation of an asset is not appropriate because revenue generated by an activity that. IFRS 16 excel examples.

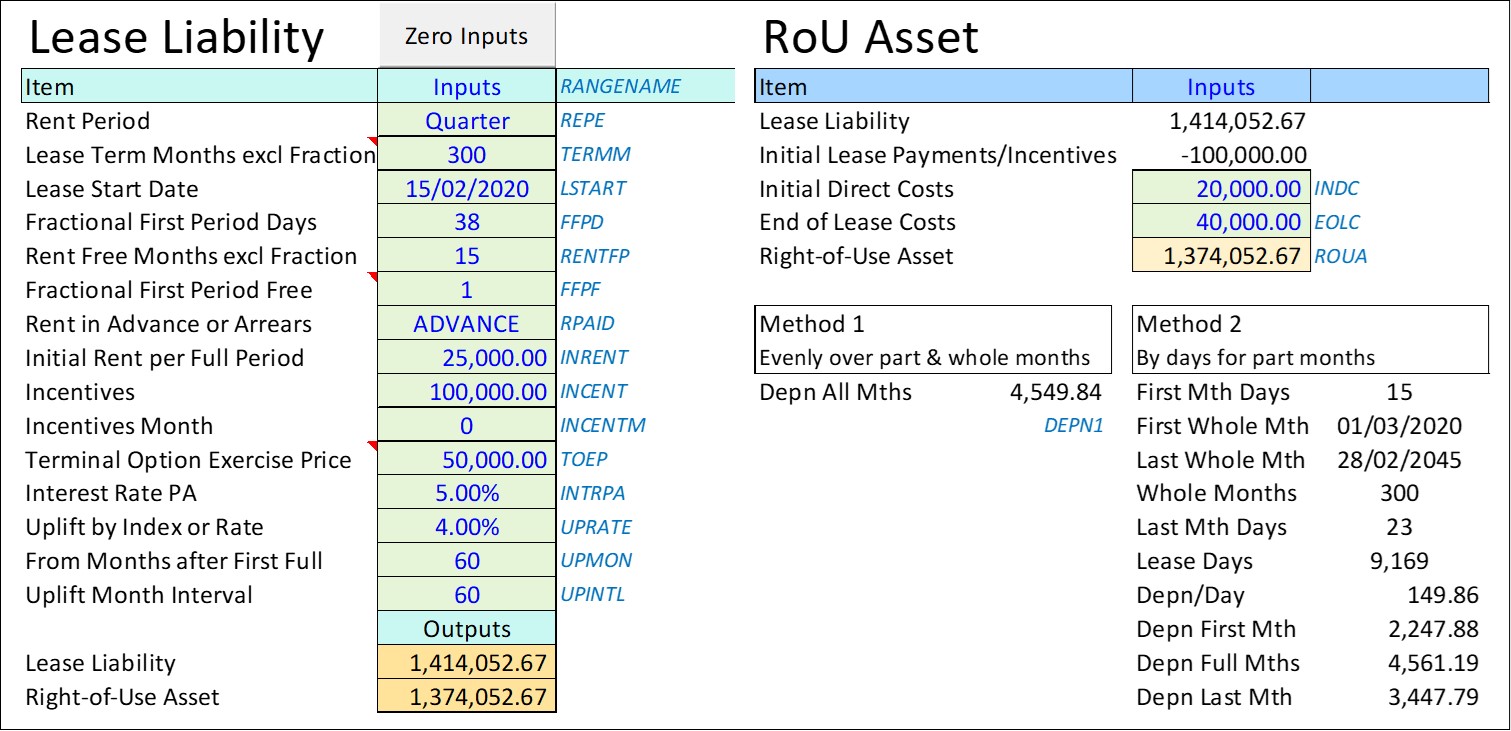

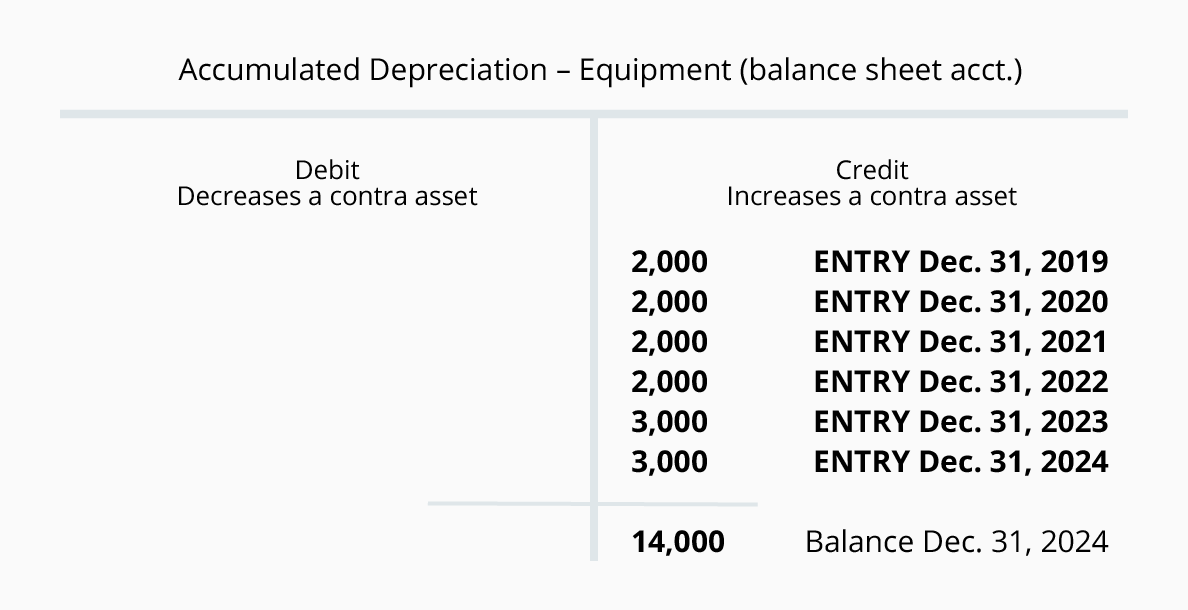

The determination of the accumulated depreciation does not. Initial measurement of the right-of-use asset and lease liability quarterly lease payments initial. Lease calculation provides a logical model to understand the calculations that have to be made in accounting for IFRS 16 Leases.

Get QuickBooks - Top-Rated Online Accounting Software For Businesses. Initial measurement of the right-of-use asset and lease liability. Unlimited users pay-per-lease pricing SOX compliant 99 client renewal rate.

Reduce Your Income Taxes - Request Your Free Quote - Call Today. International Financial Reporting Standard IFRS 16 Leases - was issued in January 2016 and in comparison to its predecessor International Accounting Standard IAS 17 makes. Where the level of lease finance changes.

Ifrs 16 Leases Impact Challenges And Solutions Deloitte Central Europe

Property Plant And Equipment Ppe Assets Acquisition Depreciation And Disposals Ifrs Aspe Youtube

Ifrs 16 Calculator Tool Aoraki Analysis

Example Lease Accounting Under Ifrs 16 Youtube

Lessee Accounting Under Ifrs 16 Annual Reporting

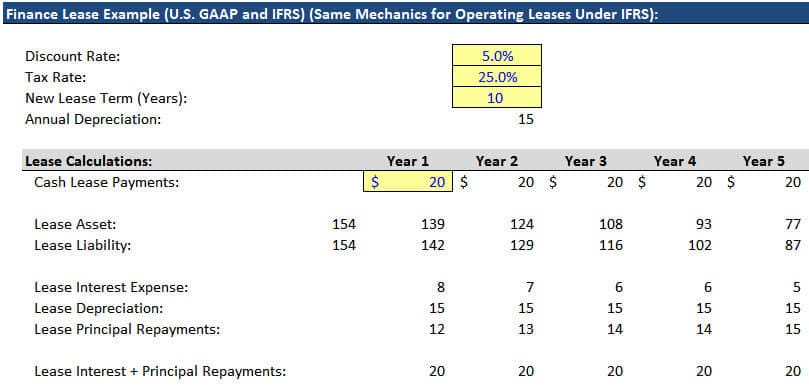

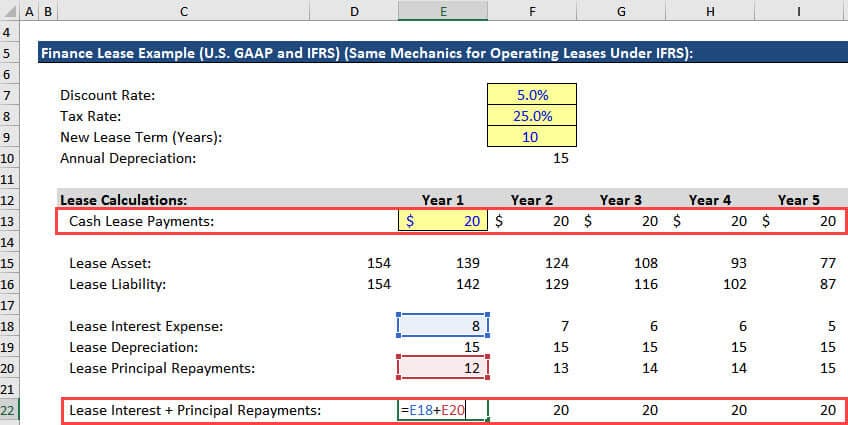

Lease Accounting Operating And Finance Leases And Valuation

How To Calculate A Lease Liability And Right Of Use Asset Under Ifrs 16

Ifrs 16 Leases The Impact On Business Valuations Accountancy Age

Ifrs 16 Leases Summary Example Journal Entries And Disclosures Material Accounting

Accounting For Leases The Marquee Group

How To Calculate A Lease Liability And Right Of Use Asset Under Ifrs 16

How To Calculate A Lease Liability And Right Of Use Asset Under Ifrs 16

How To Calculate A Lease Liability And Right Of Use Asset Under Ifrs 16

Balance Sheet Definition Balance Sheet Good Essay Effective Resume

Straight Line Depreciation Accountingcoach

Lease Accounting Operating And Finance Leases And Valuation

Declining Balance Depreciation Calculator